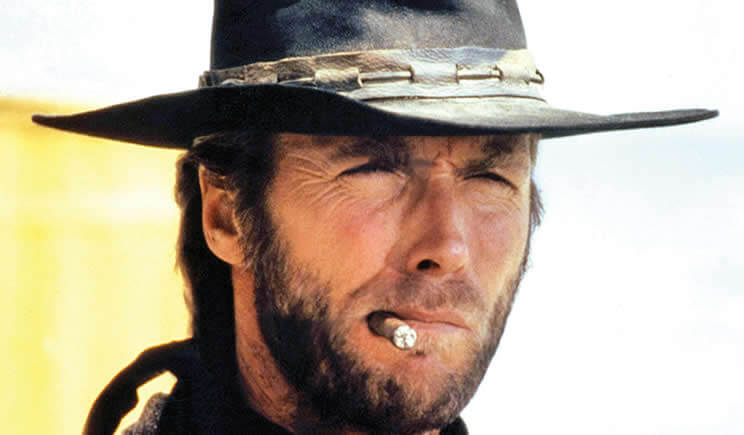

Go ahead make my Day

Give me a brief description of your credit situation.I will reply on the same business day or within 24 hours.

Ugly Credit is not a Problem

New vehicle prices have been rising steadily over the years leaving the buyer no choice but to deal with a 72 month (or more) loan replacing the usual 60 month term common only a few years ago. New vehicle owners want to only pay a regular monthly amount they can afford and the only path to take is with long term loans. Currently the average price of a family type vehicle in Canada is $34,000 which can be bargained down to $30,000 with dealer discount offers.

Good Credit vs Ugly Credit

Consumers with good credit have a great chance of receiving extended loan terms. The logic here is that the longer the duration of the loan, the greater the risk of missed payments, making the car worth nothing toward the end of the term. Therefore bruised credit borrowers are not usually welcomed by new car dealers.

If you have good credit it would be wise to fill in the application form on this website. The owner of Guaranteed Auto Loans, Rob Taggart, has been in the loan industry for 25 years and has well established relations with all the finance companies, chartered banks and credit unions where any source of money in Canada could possibly come from. Lending institutions will most of the time offer loans with interest rates that are higher than their bottom line. Rob already knows what their bottom line is. He bypasses lenders who will not be a good fit for the credit rating of the person applying for the loan. He knows exactly who to go for to get the best rate possible after reviewing your application for you! He also knows which vehicles from the wide selection of his 300 vehicle inventory would suit your credit situation so as to not waste your time. Reviewing your application, approval of the loan and getting you into a vehicle is usually done in one day!

Bad or Ugly Credit

Those who have less than perfect credit won’t be able to get a loan from a prime lender like a bank; rather they will go to a subprime lender. This is a financial institution that is will take a risk by giving a loan at a higher rate of interest. These percentages may vary widely among the competing subprime lenders.

The trick in this situation is to get the lowest rate possible despite the low credit rating. The wisest move to get a good rate on a loan with bad credit is to use a professional who knows the ropes. A professional is defined as someone who does something for a profession. This is all Rob Taggart does all day long. He has all of the finance company rates at the tip of his fingers and he will source out the lowest rate possible for any credit situation. A 1 or 2 percent reduction on a loan rate will make a big difference on the payment amount the buyer can afford for loans on a long term when they are over $20,000.

If the borrower has no choice but to get a loan at a high interest rate because of a low credit score, Rob has an ace up his sleeve. He has created his very own “Credit Rebuilder Program” to fix anyone’s credit. It is quite common for him to get someone with even 2 bankruptcy’s who is paying some ridiculous high rate at say 29% down to 10% after a year and then down to whatever the going prime rate is the year after that. He will demonstrate to the buyer each step of getting back to normal and even getting them into a brand new vehicle by diligently following the program.