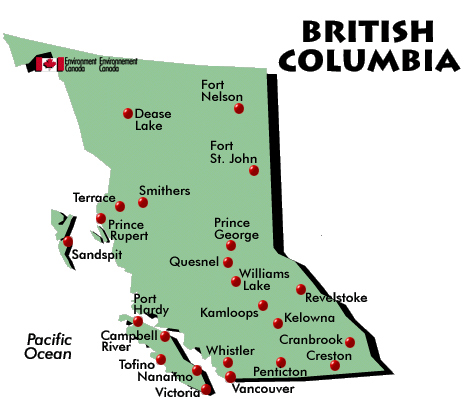

People living in British Columbia rely on car loan services in order to meet their transportation needs. With vehicle costs increasing exponentially, purchasing one without assistance has become increasingly challenging. Car loans allow individuals to secure funds they need while spreading out payments over time with flexible monthly installments and taking advantage of incentives or discounts offered through these loans – providing more financial flexibility when purchasing vehicles in British Columbia.

Car loans often cause problems due to insufficient research and understanding of all costs and risks involved.

Car loans can be an effective way of purchasing a vehicle, but there may be potential pitfalls when using this financing option. One such risk is that the loan amount may not cover all the expenses related to buying the car in full. This can force the borrower to pay out-of-pocket for any discrepancies; furthermore, the interest rate on the loan could be higher than expected, leading to higher monthly payments throughout the loan’s tenure. Additionally, the borrower may not be able to meet payments on time, which could incur late fees and penalties. Finally, they could no longer afford payments altogether and end up resulting in repossession of their car – it is therefore essential for prospective car loan applicants to consider all potential issues when taking out such loans.

Signs That You May Need A Car Loan Include A Lack Of Funds for Down Payment, Difficulties Saving For Car, And Needing One Daily for Transportation.

Car loans may be beneficial in several situations: If you do not have enough savings saved up for purchasing a vehicle outright, taking out a car loan might be the way to go; similarly if your credit score falls under scrutiny; thirdly if you do not have the ability to put down large deposits; fourthly if need longer loan payments to make things more manageable; finally if a longer repayment term makes payments easier; car loans might just be your answer! In summation if any of these scenarios apply to you it might be time to investigate taking out car loans as it will make payments more manageable; in conclusion if any of these situations exist then perhaps taking out car loan is worth consideration – perhaps.

One potential solution to the car loan dilemma may lie in providing more financial literacy education.

Solving British Columbia’s car loans problem requires a multifaceted strategy. First and foremost, consumers must be protected against predatory loaners. The provincial government should take necessary steps to guarantee protection. To do this effectively, the provincial government must introduce legislation regulating car loan terms and providing protections against any unfair terms and conditions. Furthermore, financial institutions must collaborate in making car loan options more available for those with lower incomes and poor credit profiles. Provide incentives for banks and other lenders to offer car loans with more reasonable interest rates and terms. Finally, the provincial government must be proactive in providing education on the risks of taking out car loans as well as managing debt responsibly and budgeting effectively. By taking these steps, British Columbians will have access to information they need for informed decision-making when it comes to car loans.

Guaranteed Auto Loans Can Provide Reliable Solutions To Individuals Struggling with Financial Unstability in British Columbia.

Guaranteed Auto Loans of British Columbia is an outstanding resource for those struggling to secure car loans due to poor credit. We specialize in offering auto loans to those with no history, no income history and low income levels – our team of financial experts will work closely with you to craft an individual loan package tailored specifically to your individual needs – low rates, flexible repayment terms and no pre-payment penalties are among our many loan options – plus free consultations so we ensure the best deal. With Guaranteed Auto Loans you can obtain the car that’s perfect no matter your current financial status!

Guaranteed Auto Loans Provides Reliable And Secure Auto Loans In British Columbia