Do not despair if you have bad credit and require a car loan! The first step should be getting pre-approved, either online or at a bank/credit union near you. With your pre-approval in place, shopping can begin – select cars within your budget that offer manageable monthly payments and the highest likelihood of approval! Once found, apply for your loan with all required paperwork ready; just remember your proof of income and driver’s license are also essential components to approval! Hopefully soon enough you will be driving off with your new ride in no time!

Tips to Help Improve Your Credit Score for a Bad Credit Car Loan

One of the key components of qualifying for a bad credit car loan is increasing your credit score. Here are some strategies for doing just that: make sure all bills are paid on time, keep credit utilization low and don’t open too many new accounts; also, regularly review your credit report to check for errors or inaccuracies and pay any outstanding debt immediately; with some effort you could increase your score and qualify for one!

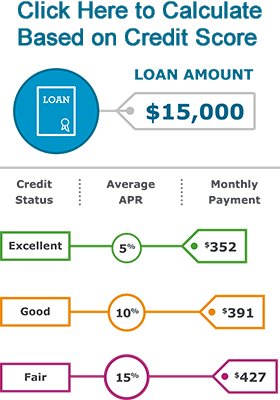

Pros and Cons of Bad Credit Car Loans Bad credit car loans can be an ideal way to acquire a vehicle when your credit rating falls short. On one side, these loans allow anyone with poor credit access to financing – including loan terms that may be more flexible than traditional ones – although on the other hand interest rates tend to be higher and down payments may require greater commitment; as well as increased monthly payments than with traditional loans. With that being said, bad credit car loans should still be considered an excellent way to acquire one but you should also be aware of their possible drawbacks before signing on the dotted line!

The Pros and Cons of Bad Credit Car Loans

Bad credit car loans can be a great way to get a car when you don’t have the best credit score. On the plus side, you can get a car even if you have bad credit, and the loan terms are usually more flexible than traditional loans. On the downside, the interest rates are usually higher than traditional loans, and you may have to put down a larger down payment. Additionally, you may have to pay a higher monthly payment than you would with a traditional loan. All in all, bad credit car loans can be a great way to get a car if you don’t have the best credit score, but you should be aware of the potential drawbacks before you sign on the dotted line.