Our Blog

Bad Credit Car Loan | Best Choice For Your Dream Car in 2023

Bad Credit Car Loan is loans specifically tailored for individuals with either no history of credit, limited history or poor history of credit. It provides those who have been turned down financing from traditional lenders with access to funds they require for...

How to Get Approved for a Bad Credit Car Loan

Do not despair if you have bad credit and require a car loan! The first step should be getting pre-approved, either online or at a bank/credit union near you. With your pre-approval in place, shopping can begin - select cars within your budget that offer manageable...

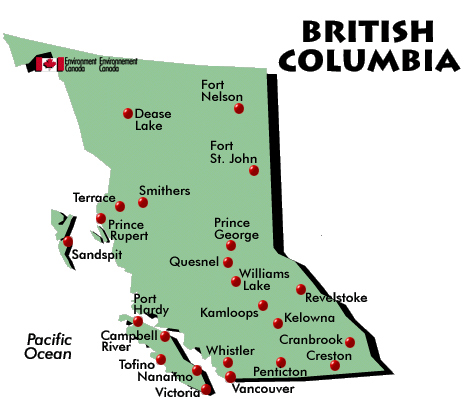

Car Loans In British Columbia

People living in British Columbia rely on car loan services in order to meet their transportation needs. With vehicle costs increasing exponentially, purchasing one without assistance has become increasingly challenging. Car loans allow individuals to secure funds...

Get a Car Loan with Bad Credit

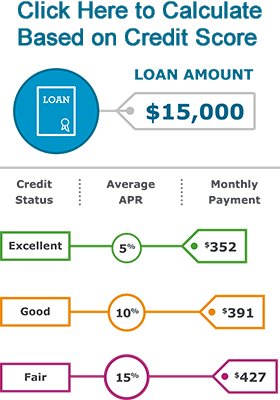

Getting a car loan with bad credit can seem like an impossible task, but it doesn't have to be. With the right information and resources, you can take the necessary steps to get a car loan and rebuild your credit at the same time. Qualifying for a Car Loan with...

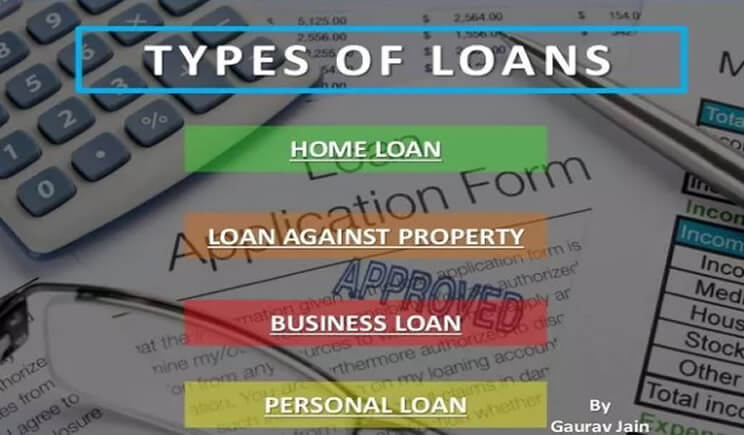

Types of Loans

Payments on these loans are made at defined intervals of time, usually monthly. The longer it takes to pay back the loan, the more interest is paid. Home and vehicle loans fall into this category.

Secured Car Loan

What is the difference between secured loans, unsecured loans, student loans, and credit cards?

Bruised Credit

New vehicle owners want to only pay a regular monthly amount they can afford and the only path to take is with long term loans. Currently the average price of a family type vehicle in Canada is $34,000 which can be bargained down to $30,000 with dealer discount offers.

Guaranteed Approval Auto Loans in BC

If you are walking into a situation where your credit score is low some dealers or financial institutions will take your information and give it to many lenders all at one time. The lenders will then create multiple hits on your credit report to get information on you.

Instant Online Auto Loan Approval

The person reading the form will immediately be able to tell what kind of loan amount, payment, and length of term you qualify for from the required fields on the form. He will then send you an email, or text, or call you.